Table of Content

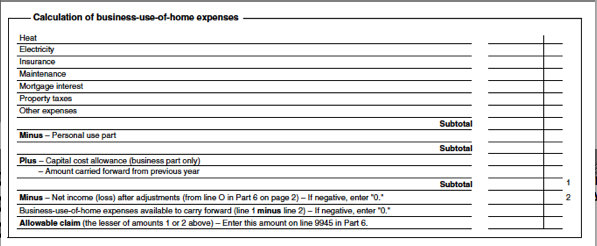

The standard deduction and the additional amounts for blind and over age 65 filers are adjusted annually for inflation. Direct expenses are costs that only apply to your home office, such as furniture and equipment, supplies, and so on. For the simplified option of calculating your home office deduction, do the calculation on Line 30 of Schedule C for sole proprietors or single-member LLC members. For the actual-expenses option, you’ll need to use IRS Form 8829 to calculate these expenses. There are qualifications and limits for this deduction, so getting help from a licensed tax professional is an important first step to adding this deduction to your business tax return. You can take a tax deduction for your use of this space if you use it regularly and only for your business.

The state income tax allows all federal itemized deductions, except the deduction for state income or sales tax. If you work at home as an employee — even for your employer’s convenience — you can no longer deduct your out-of-pocket expenses. The new tax law did away with deductions for unreimbursed employee expenses. Unrelated expenses are those for areas of the house that don’t affect the business space. These expenses, like lawn care and painting a room not used for business, aren’t eligible for the home business deduction.

What is the simplified square footage method?

If you use part of your home exclusively and regularly for conducting business, you may be able to deduct expenses such as mortgage interest, insurance, utilities, repairs, and depreciation for that area. You need to figure out the percentage of your home devoted to your business activities, utilities, repairs, and depreciation. The simplified method is based on the square footage of your home exclusively used for business multiplied by $5 and limited to $1,500. If your home office is 240 square feet, your home office deduction would be $1,200 . The home office deduction allows qualifying taxpayers to deduct certain home expenses on their tax return.

Minnesota maintained that order through the duration of 2020 (and it’s still in place now). If you have requested a response, we will reply within three business days. Minnesota Administrative RulesAdministrative rules adopted by the Department of Revenue to administer Minnesota tax laws.

TaxWatch

But the tax code overhaul paused that ability until the provisions sunset at the end of 2025. “There’s good news and bad news,” Barbara Weltman, the owner of Big Ideas for Small Business, explained to MarketWatch. If you’re an employee filing taxes between 2018 and 2025, you cannot claim the deduction, she said. As an example — someone who works for Uber in their marketing department is likely an employee, even if they work from home. Whereas an uber driver, who is a contractor and self-employed, yet earning money from Uber, can deduct various business-related expenses as a self-employed individual and thus reduce their taxable income.

Another example — an employee who chose to work during the COVID pandemic from his summer house can arguably claim the cost of airfare for getting there. The percentage of the mortgage, rent, utilities, and repair cost allocated to the area used exclusively for business can be claimed for reimbursement — as long as the company expense policy allows it. Certain states issued regulations that require employers to reimburse employees for pandemic-related expenses. These states include California, Illinois, Minnesota, Iowa, Montana, New Hampshire, and the District of Columbia. There are no federal rules requiring companies to reimburse individuals in other states as long as those expenses don’t push a worker’s income to below the minimum wage.

Home Office Deduction #291822

The biggest roadblock to qualifying for these deductions is that you must use a portion of your home exclusively and regularly for your business. • For tax year 2022, the rate for the simplified square footage calculation is $5 per square foot, with a maximum of 300 square feet. An additional standard deduction amount is allowed for filers who are over age 65 or blind. In tax year 2017, the additional amount is $1,250 for married filers and $1,550 for single and head of household filers. Filers who are over 65 and blind may claim two additional standard deduction amounts.

If you purchase the "Online Book and Online Exam" option of a course, you get anytime access to the online course and the online exam. If you use a whole room or part of a room for conducting your business, you need to figure out the percentage of your home devoted to your business activities. Home office deductions are available for homeowners and renters and apply to all types of homes. IRS Form 8829 is where you show your math in claiming the deduction, said Goldberg, who’s personally been working from home for 10 years.

Regular Method

Alas, if you’re an employee who has been working from home due to the COVID-19 pandemic, that amazing home office tax deduction you’ve heard so much about does not apply. There are more and more people working from home, staring their own businesses and freelancing from home than ever before. As the state of the business world changes, and the focus turns to home-based, small and local businesses, and so too should your tax preparation. If you have a home office—one that you use for your own business, then you may be able to take the home office deduction, one that can save you a bundle on your taxes every year. Of course, it’s just as complicated as every other deduction, so always check with your accountant. In the meantime, here is a look at some of the deductions you can take when you have a home office and just how you can take them, according to the IRS.

Unfortunately, the TCJA suspends the deduction for miscellaneous expenses through 2025. Without further action from Congress, employees won’t be able to benefit from this tax break for a while. However, deductions are still often available to self-employed taxpayers. To qualify under prior law, a home office had to be used for the “convenience” of your employer.

Indirect expenses are costs that don’t exclusively apply to your home business, such as utilities, rent, insurance, security system fees, and similar costs. Beginning with 2013 tax returns, the IRS began offering a simplified option for claiming the deduction. This new method uses a prescribed rate multiplied by the allowable square footage used in the home. What do you do if you have a home studio in your backyard, or a garage or barn that you’ve converted into an office space? If you use that space regularly and exclusively for conducting, then you can still deduct your expenses.

To know if you qualify for the deduction, you need to regularly use a part of your home exclusively for the task of conducting business. If you just occasionally use your home computer to check your work email, for example, that doesn’t qualify as regular and exclusive use. However, if you have an extra room that you regularly use to work from home, then you can take that deduction.

With either method, the qualification for the home office deduction is determined each year. If you're an employee of another company but also have your own part-time business based in your home, you can pass this test even if you spend much more time at the office where you work as an employee. Clearly, if you use an otherwise empty room only occasionally and its use is incidental to your business, you'd fail this test.

We’ll find every industry-specific deduction you qualify for and get you every dollar you deserve. Making money from your efforts is a prerequisite, but for purposes of this tax break, profit alone isn't necessarily enough. If you use your den solely to take care of your personal investment portfolio, for example, you can't claim home office deductions because your activities as an investor don't qualify as a business. The standard deduction and also the additional deduction allowed for taxpayers who are over 65 or blind, are the same at the state level as at the federal level. If you use the actual-expenses method and you own your home, you can take a depreciation deduction for the year for “wear and tear” on this part of your home. You can’t depreciate the cost or value of the land your home is on, but you can depreciate the portion of property taxes and mortgage interest for this business-only area.

Here’s what taxpayers need to know about the home office deduction

These individuals are guaranteed a minimum standard deduction, which is adjusted annually for inflation. The simplified method is still only available to self-employed people who run their businesses from home. As we discussed earlier, traditional employees who work from home can no longer claim these home office expenses as deductions on their tax returns. If you’re self-employed, you can still claim the home office tax deduction for qualifying costs, whether you use the actual expenses or the simplified method. The deduction decreases your business income, and therefore, your gross income. Home Office Deduction examines the federal income tax deduction for business use of a home.

No comments:

Post a Comment